Australian Consumer Sentiment During COVID-19 and its Implications for Retailers and Brands

Understanding customer profiles, their drivers and sentiment during times of dramatic change is of vital importance for all retailers and brands.

Just as change affects those of us that work in retail so dramatically in times like this, so too our customers.

There is a need to listen to how our customers behaviours are changing so you can plan your future strategy and be ready for the rebound that will happen. From being unsure and uncertain through to familiarity and certainty in the norms of behaviour that existed before.

To gain these customer insights in these uncertain times Retail Doctor Group in partnership with Lightspeed have reached out to Australian Consumers to understand how COVID-19 is affecting their behaviours and their spending patterns.

This data allows retailers to clearly predict how customers will react during this time, which customers are most affected and which verticals this will have an impact on.

It is important to remember that not all customers are equal and it is important to utilise this consumer sentiment data along with your customer insights to have a clear understanding of where to aim your strategy during this time to gain the most connection and penetration with your customers as they return to patterns of familiarity.

Consumer Spending Habits

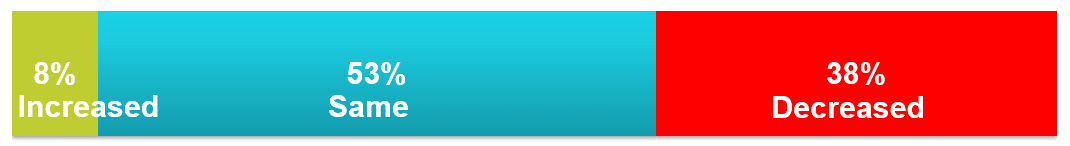

The first insights from the data showed that 53% of Australian consumers are saying that their income has not been affected during this period. This is a positive outcome for retailers as this shows that consumer spending should normalise quite quickly during this period when customers establish their routine.

Figure 1: Retail Doctor Group – Lightspeed Australian Consumer Research into behaviours relating to Covid-19- Conducted 26/03/20 Q1 – How has your household discretionary income changed due to COVID 19? N=318

Conversely, when you look deeper into this data, it shows that those most affected are younger consumers (Between 18-35) and females . So what does this mean for your business?

Retailers who have key customer demographics in these areas may notice the change in behaviour and reduced spending during this period. However by understanding the drivers for these consumer profiles, businesses can then begin to tailor communications, offers and products to be able to support these customer groups.

It is important to think about the rebound, how will your customers react when this is over? Ensure to utilise this time to plan your rebound strategy.

Keeping close to your customers during this period, being supporting, informative and addressing their needs will allow for a strong connection and loyal customers. Customers respond to crisis in different ways and it is therefore important to tailor messages, platforms and offers to connect with your customers on an emotional level.

Are There Differences in Attitude to Demographics

The data also shows us that metro areas are more affected than regional, with 73% of regional consumers saying that their income has either not being affected or has increased. Retailers should be aware of utilising different messaging to these consumers who will be looking for different solutions during this time.

Less or More to Spend ?

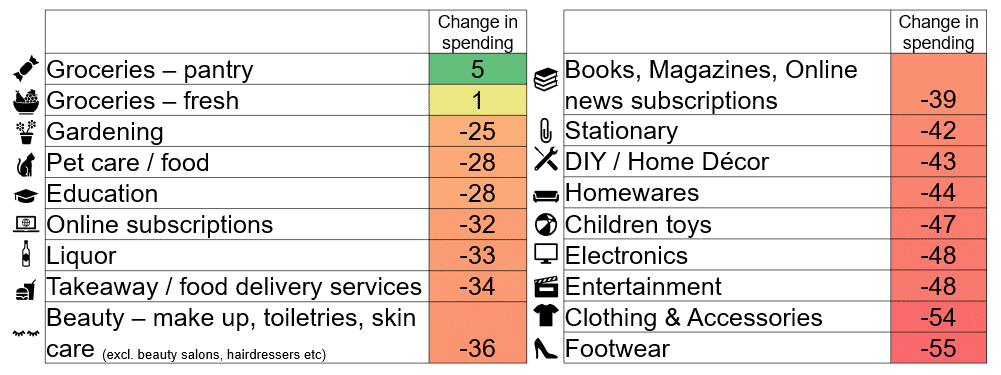

Consumers were then asked how they expect their spending to change over the next 4 weeks by category. Groceries, pantry items and hobbies seem to be the items least affected.

Figure 2: Retail Doctor Group – Lightspeed Australian Consumer Research into behaviours relating to Covid-19- Conducted Q2 – How do you expect your spending to change in the following categories over the next month? Q3 – Are there any categories that you will start to shop online that you would not have previously considered? N=318

By understanding what categories consumers are considering spending in can be utilised to determine what mix of products and services you can offer and highlight in communications to assist delivering what your customers need.

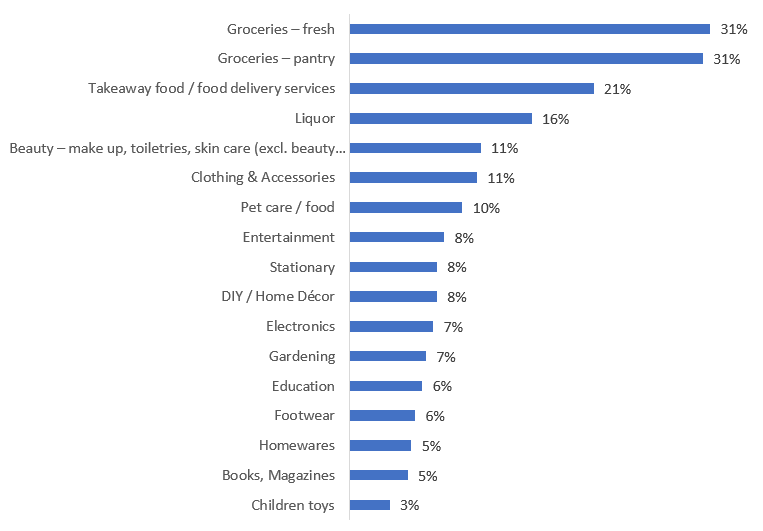

Figure 3: Retail Doctor Group – Lightspeed Australian Consumer Research into behaviours relating to Covid-19- Conducted Q3 – Are there any categories that you will start to shop online that you would not have previously considered? N=318

Fulfilment Matters

The research also highlights how customers are changing their behaviours in the way they interact with retailers.

In all categories customers are now looking for the ability to purchase online, so it is important to re-visit your current path to purchase for your customers. How do they want to interact with you and what channels do they want to utilise? What changes do you need to make to your omni-channel strategy to ensure you can deliver to these expectations? Due to social distancing we are now seeing customers become more digital savvy and therefore have higher expectations for how they interact with retailers. So a thorough review is needed of what your customers are expecting versus what you are delivering to them on their journey with you.

This research highlights the importance of understanding your customers behaviours and also coupling this with “WHY” they are behaving this way. By developing this understanding you can tailor your offering, your strategy for rebound and create stronger connections with your customers that will lead to long term loyalty.

About the Author

Anastasia Lloyd-Wallis , General Manager Consumer Insights & Projects, Retail Doctor Group

Anastasia leads the Consumer Insights division of Retail Doctor Group. With a professional background as a scientific analyst and a Masters in Mathematics, Anastasia has developed a unique and proprietary approach to help retailers and FMCG brands understand their consumers and market opportunities.

-

Get your FREE ticket

- REGISTER FOR FREE