Navigating Natural & Organic: Julia Illera, Euromonitor International

The natural and organic industry is continuously growing and shifting, with new trends, regulations, products and practices being introduced into market everyday. How does one keep on top of it all? Naturally Good has you covered, as we speak to industry professionals and experts on the hottest topics and trends, business practices and solutions, and what’s happening in the natural and organic industry.

With over 10 year’s research experience, across Australasia and the Americas, Julia Illera, Research Consultant at Euromonitor International, possesses strong strategic, quantitative, and qualitative research experience within several consumer goods and service industries. She gives us a detailed run down on how the natural and organic industry has faired over the recent years, how the Australian industry compares to its international counterparts as well as how consumer behaviour has influenced the growth of natural and organic.

From a global perspective, how have you seen the natural and organic industry develop over recent years?

Euromonitor does not track the natural and organic market per se, instead what we look at is how natural and organic claims and labels used for marketing purposes have evolved across multiple consumer goods industries. In that sense, we have noticed these labels continue to gain relevance across different industries. Simpler ingredients lists and natural ingredients are still winning across most regions, as consumers prioritise health in light of COVID-19. Consumers are returning to back-to-basics options, choosing simpler and clean label products which they believe produce better results when it comes to overall health.

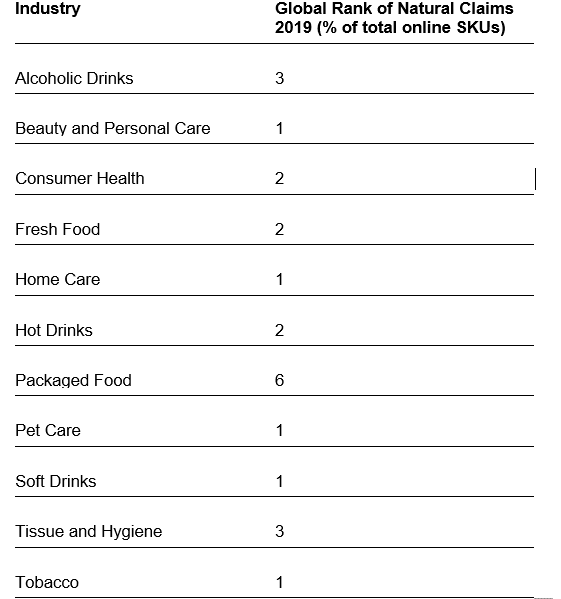

Using Euromonitor’s Product Claims and Positioning system, we found that natural claims have moved into the top five online product claims across all industries globally. However, despite their popularity in marketing, natural claims accounted for no more than 6% of total online SKUs globally across any industry in 2019.

Source: Euromonitor International’s Product Claims and Positioning

Are there any particular sectors within the natural and organic industry that have seen substantial growth?

Using Euromonitor’s Via Pricing system, we found that in beauty and personal care products with a natural claim are generally more prominent than those with an organic claim. Through the daily extraction of online retailer data, in a global sample of almost five million SKUs across beauty and personal care categories, in 2019 products with a natural claim accounted for 5% of the total and those with an organic claim only 2%.

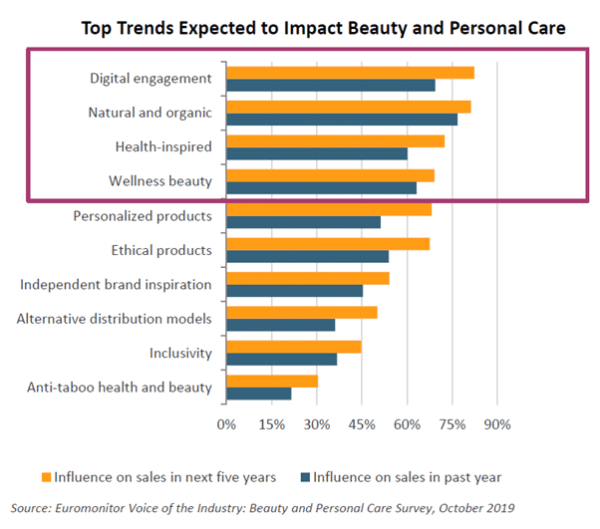

In beauty and personal care, natural and organic have influenced significantly the performance of the industry and are anticipated to continue to be key trends in the next five years.

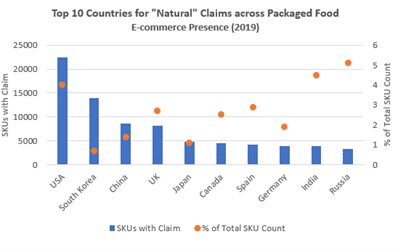

In industries such as packaged food we have also seen an increased demand for natural and traditional solutions in connection with preventative health. In fact, using Euromonitor’s Product Claims and Positioning system the US was identified as the number one country in 2019 with “Natural” claims across packaged food through e-commerce channels.

Source: Euromonitor International Product Claims and Positioning

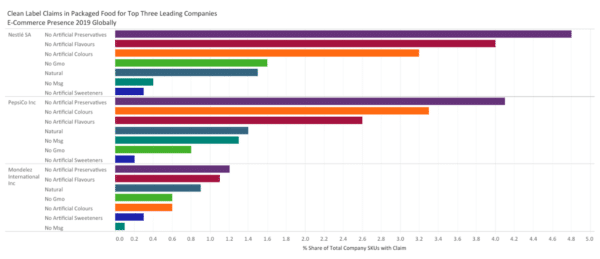

The natural movement in packaged food is one of the top five strategies that food companies are using to boost their longer-term growth using product claims. Consumers increasingly seek natural and authentic products, with no artificial colours, flavours or sweeteners as ultra-processed food is increasingly under fire.

Source: Euromonitor International Product Claims and Positioning

A new wave of interest in organic food is being driven by the impact of pesticide use on biodiversity and individual health. While the standards of organic farming vary from country to country these generally restrict the use of certain pesticides and fertilisers, try to ensure the retention of biodiversity, cycle resources and (overall) drive an ecological balance. Choosing such food for personal health reasons is a well established motivator, with consumers attempting (for example) to avoid ingesting foods grown using pesticides, or GMO crops. However increased concerns for the well being of the planet and greater appreciation of our food systems’ ecological impact has also increased the popularity of organic.

What are the major differences you see between these different markets for the natural and organic industry?

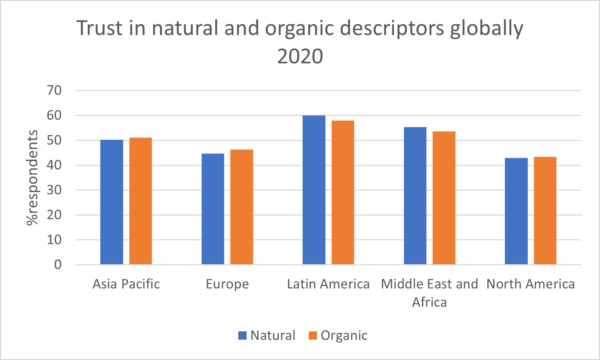

Looking at different regions, Euromonitor lifestyle survey found that in Latin America more consumers find natural and organic descriptors trustworthy when used to label products than any other regions. Nevertheless, in all regions these descriptors are highly trusted with over 43% of consumers across all regions indicating they consider these descriptors trustworthy.

Source: Euromonitor International’s Lifestyles Survey (2020), fielded January to February 2020

Q: How trustworthy do you consider the following descriptors when used to label products?

Looking to build your natural and organic ranging or get your products up onto shelves (physical and online) and into the hands of consumers? Head to the Naturally Good Product Directory and list your business today.

-

Get your FREE ticket

- REGISTER FOR FREE