Speaker Series Spotlight: The New Normal in Retail – Sales, Stock and Supply

More than ever, Australian consumers are educated, taking charge of their health and actively looking for alternative solutions to treat and prevent illness. More than 70 per cent of people are regularly using complementary medicines with the market expected to reach $6 billion by 2023.

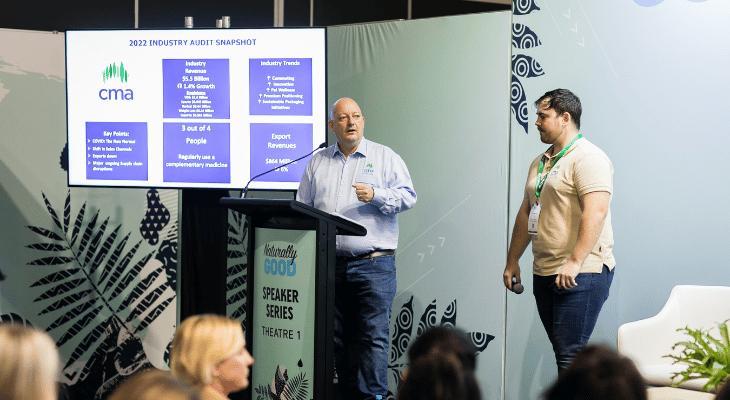

However, the industry now faces pandemic-related supply chain challenges, accelerated in many ways by COVID-19 according to Complementary Medicines Australia CEO, Carl Gibson, and Industry Development Manager, Cameron Thorpe.

This year Carl and Cameron joined a group of more than 30 speakers presenting on a wide range of business topics at the 2022 Naturally Good Expo.

As part of the peak industry body representing the supply chain from manufacturers, brands to retailers, Carl and Cameron discussed the challenges in accessing world class ingredients, shared industry sales data, highlighted chronic diseases driving growth and reflected on current innovations and trends.

Here are some of the valuable points raised by Carl in their presentation – The New Normal in Retail – Sales, Stock and Supply.

Chronic diseases driving growth

It is a sad fact that over 78 per cent of Australians have a long-term health condition, with nearly half reporting at least one chronic condition. Mental and behavioural conditions top the chronic disease lists at more than 20 per cent, followed by back problems and arthritis. Asthma and chronic obstructive pulmonary disease are also continuing to grow. As a result, we have seen an increase in mood, sleep and pain products.

Primary customers

We’re now at a point where seven out of 10 people regularly use a complementary medicine. Women have always been the predominant decision makers for purchases and 83 per cent of females are more likely to have purchased a complementary medicine in the last year than men. Interestingly, women buy more vitamin and mineral products, and men buy more Omega-3 fatty acids and fish oil.

Key stats and observations regarding complementary medicine

- 3 out of 4 people regularly use a complementary medicine

- Export Revenues: $864 Million

- Industry Revenue: $5.5 Billion 1.4% Growth

Breakdown:

VDS: $2.6 Billion

Sports: $0.945 Billion

Herbal: $0.64 Billion

Weight Loss $0.44 Billion

Exports: $0.864 Billion - COVID-19 has had an impact on the retail distribution of Vitamins & Dietary Supplements in Australia

- Social distancing has changed consumers behaviours

- During last year 7.5% swing away from purchasing in traditional Pharmacy, to the Grocery channel

- Less foot traffic in traditional retail outlets, and consumers choosing to spend less time in store

- The Direct Selling channel has also adapted and after an initial dip in sales, now holds steady

- Increase in Online Sales, with industry focus on tackling illegal imports

*Source: Complementary Medicines Australia

Successfully navigating COVID-19 and the supply chain

The COVID-19 pandemic has brought both challenges and opportunities to the retail market in our sector. What we have seen is real innovation. One example is Chemist Warehouse – recognised as Retailer of the Year by the complementary medicines industry for their innovative three-hour delivery from their House to Yours.

Another was the launch of Healthylife, part of Woolworths Group with a brand-new online retail channel. This innovation helped meet consumer demand and orders throughout lockdowns. With the supply chain continuing to be a real challenge, the Industry Association has been working closely with the Government to ensure continuity of supply.

How pharmacies can remain competitive in this space

Innovation is key. The lesson from Chemist Warehouse is that if your customers can’t come to you, go them. We’ve been hiding behind face masks for several years, and as we come out of hibernation, we need all the help we can get. People are interested in beauty products as they enter the outside world, others are seeking out anxiety products to help them socialise, whilst for some, prioritising a good night’s sleep has become paramount.

We know consumers are more aware about their immunity and we have seen huge growth in the probiotics category. We expect more growth in both pre and postbiotics. Some of the odd statistics during the COVID-19 pandemic days is that sexual health products declined – so we aren’t expecting a COVID baby boom any time soon! However, the good news is that as our hyenine improved, colds and the flu weren’t as prevalent – although this is on the rise again since restrictions lifted.

Predictions over the next five years

Whilst it’s always difficult to predict the future – who could have foreseen a global pandemic – we do see trends now that will make an impact in the future. We are seeing a growth in youth obesity and know many people, especially the young, have been affected by long lockdowns and restricted socialisation. The number of prescriptions for medicinal cannabis has grown 88 per cent since January 2020 with those aged 18-30 seeking help for anxiety and sleep.

Thanks to our speakers for being part of the 2022 Naturally Good Speaker Series. If you would like to read more key take-aways from our Speaker Series sessions, subscribe here for regular updates. You can also download the presentation slides here.

-

Get your FREE ticket

- REGISTER FOR FREE